An increase in the usage of electronic wallets (e-wallets) has recently occurred in Malaysia. This is due to the fact that they offer a number of advantages over traditional methods of payment, such as credit and debit cards. In this article, we will discuss what e-wallets are, how they work, and some of the benefits that they offer consumers and businesses in Malaysia. We will also take a look at some of the most popular e-wallets in the country and provide you with information on how to sign up for them.

What Are E-Wallets?

With e-wallets, you may transfer, receive and keep money online. You may buy things online or send money to other individuals using them. In most cases, e-wallets are linked to your bank account, so that you can easily top up your wallet when necessary.

They came to the United States in 2012 and have risen in popularity ever since. As of 2018, there are over 16 million e-wallet users in Malaysia. This number is expected to grow to 24 million by 2025. Malaysians tend to use e-wallets to pay for small purchases, such as food and drinks. However, they can also be used to pay for larger items, such as plane tickets and hotel rooms. Some of the popular e-wallets in Malaysia are Touch n’ Go, DuitNow, and PayPal.

How Do E-Wallets Work?

When you want to make a purchase with an e-wallet, you will first need to add money to your wallet. This can be done by linking your bank account or credit card to the wallet, or by transferring money from another person’s wallet. Once you have funds in your wallet, you can then use them to make purchases online, or send money to other people.

To make a purchase, you will need to enter your wallet’s ID number or QR code at the checkout. After that, you will be asked to enter your personal identification number (PIN) or password. After you have completed these steps, the money will be sent from your wallet to the account of the retailer automatically.

How Are E-Wallets Being Used in Malaysia?

Malaysians tend to use e-wallets for a variety of reasons, including the following:

To Make Online Purchases

Almost 80% of the online stores in Malaysia accept e-wallets as a form of payment, which makes it very convenient for consumers who want to make online purchases. This is because they do not have to enter their bank account or credit card details when making a purchase. Which in another way, protects their personal information from being compromised?

To Send and Receive Money

It is also possible to utilise electronic wallets to transmit and receive money. This is a convenient way to transfer money to friends and family, as well as to pay for goods and services. You may notice people transferring funds to each other daily, especially during special occasions such as Chinese New Year and Hari Raya, where it replaces the traditional “AngPao” gifting.

To Pay Bills

In Malaysia, you can also use e-wallets to pay your bills. This covers the costs associated with telecommunications and other utilities, such as water and power. It provides a huge benefit where you are not required to queue up at the bill payment counter, and you can do it anytime and anywhere.

To Earn Rewards Points

Some e-wallets also offer rewards points that can be redeemed for a variety of items, such as vouchers and discounts. This is an added benefit that encourages people to use e-wallets more frequently.

To Gamble in Online Casinos

There are still a significant number of individuals that gamble in Malaysia despite the fact that it is against the law. And with the recent rise of online casinos, some people have started using e-wallets to gamble. This is because it is a convenient way to transfer money to an e-wallet online casino, and it also allows them to keep their gambling activities hidden from the authorities.

With the rising of e-wallets, online casinos in Malaysia have started to accept this mode of payment. Just like making an online purchase, you will only need to enter your wallet’s ID number or QR code at the casino’s checkout. And you will then be prompted to enter your PIN or password. After you have completed this step, the cash will be sent from your wallet to the account that is associated with the casino.

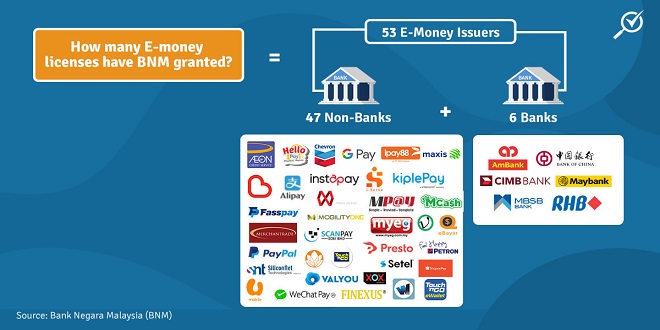

What Are the Most Popular E-Wallets in Malaysia?

There are a number of different e-wallets that are available in Malaysia, but the most popular ones are Boost, GrabPay, DuitNow, and Touch ‘n Go.

Boost Wallet

Boost is a mobile wallet that was launched in 2017. It is one of the most popular e-wallets in Malaysia, with over two million users. The app can be used to make purchases at participating merchants, as well as to send and receive money. In addition to this, you may use Boost to pay your own bills and accumulate rewards points.

GrabPay

GrabPay is another popular e-wallet in Malaysia. It was launched in 2018 by ride-hailing company Grab. The software may be used to make payments at participating retailers, as well as send and receive monetary transfers, and it also allows users to receive money. You can also use GrabPay to pay your bills.

DuitNow

DuitNow is a national QR payment system that was launched in 2019. Simply providing your mobile phone number gives you access to an interbank transfer service that enables you to send and receive money. The e-wallet has become increasingly popular in recent months, with more and more banks and merchants starting to accept it.

Touch ‘n Go

Touch ‘n Go is a mobile wallet that was launched in 2016. It is one of the most popular e-wallets in Malaysia, with over five million users. In addition to allowing users to send and receive money, the app also enables users to make payments at partner retailers. You can also use Touch ‘n Go to pay your bills and earn rewards points.

Final Thoughts

E-wallets are becoming increasingly popular in Malaysia. This is because they offer a number of benefits, such as the ability to make payments without cash, to send and receive money, and to earn rewards points. If you are looking for a convenient way to make payments, then an e-wallet may be right for you.

What are your thoughts on e-wallets? Do you think they are a convenient way to make payments? Let us know in the comments below!